Originally published on The Evolving Enterprise.

The ever-present threat of disruption is something most businesses are getting familiar with. It is the new normal. Proof enough is in how all the retail, software and health and life sciences brands continuously invest in technology to stay one step ahead of the competition.

Yet the industrial sector those that make, power and move goods at scale have continued to fall behind in R&D investment, leaving them ripe for disruption.

Industrial companies have been very successful in finding new, often tech-driven, ways to run leaner operations. This is a model that has paid dividends in the past, but is now in steady decline. Just like their counterparts in other spaces, industrial companies are rushing to find the next technology that will help them gain an edge.

What these organizations need now is larger and/or more sustainable injections of disruptive technology in their business. And they’ve traditionally taken two routes.

Acquire or accelerate

An acquisition is a tried and true method for enhancing internal capabilities. While the tech sector is already well known for high-profile acquisitions, industrial companies have been on an acquisition spree since 2007. After all, when a truly disruptive technology or entrant comes on the scene, acquisition can be a quick path to success.

Even so, these have been at the edges of companies that are hyper-focused on efficiency, now a core competency. A company that is radically different will be forced into a mould that they might not be able to work within. That makes an acquisition not only costly, but at high risk for failure.

This could be driving the growing trend of technology accelerators within or closely supported by industrial companies in recent years. These programs provide capital, working space, support and other assets that startups or new ideas need to flourish.

While an accelerator cohort can be close to the core business, working on value-added offerings, they’re still independent enough that they’re free to experiment. Instead of making an incremental improvement, industrial companies rely on these programs to capture the value from a spectrum of new inventions and processes that will make them prepared for the future.

Making waves today

Today a number of industrial companies have invested in accelerators, and used that investment to differentiate their competitive offerings to buyers, employees, investors and other stakeholders. These are companies that see the long-term value of innovation, but also how important it can be to promote their brand and solutions today.

Recently, CH Robinson invested $1 billion (€0.9 billion) over a five-year period to help better manage freight cycles. Called Robinson Labs, it will pull the expertise from data scientists in Minneapolis, Chicago, Silicon Valley and Warsaw to create personalized shipping solutions. The goal is to start off with individual customers, helping them to cut shipping costs, simplify processes and drive reliability, and then scale up to their whole network. The company is also reacting to the more than $14.4 billion(€12.9 billion) invested globally in privately owned freight, logistics, shipping, trucking, transportation management system (TMS) and supply chain visibility startups since 2013, per PitchBook.

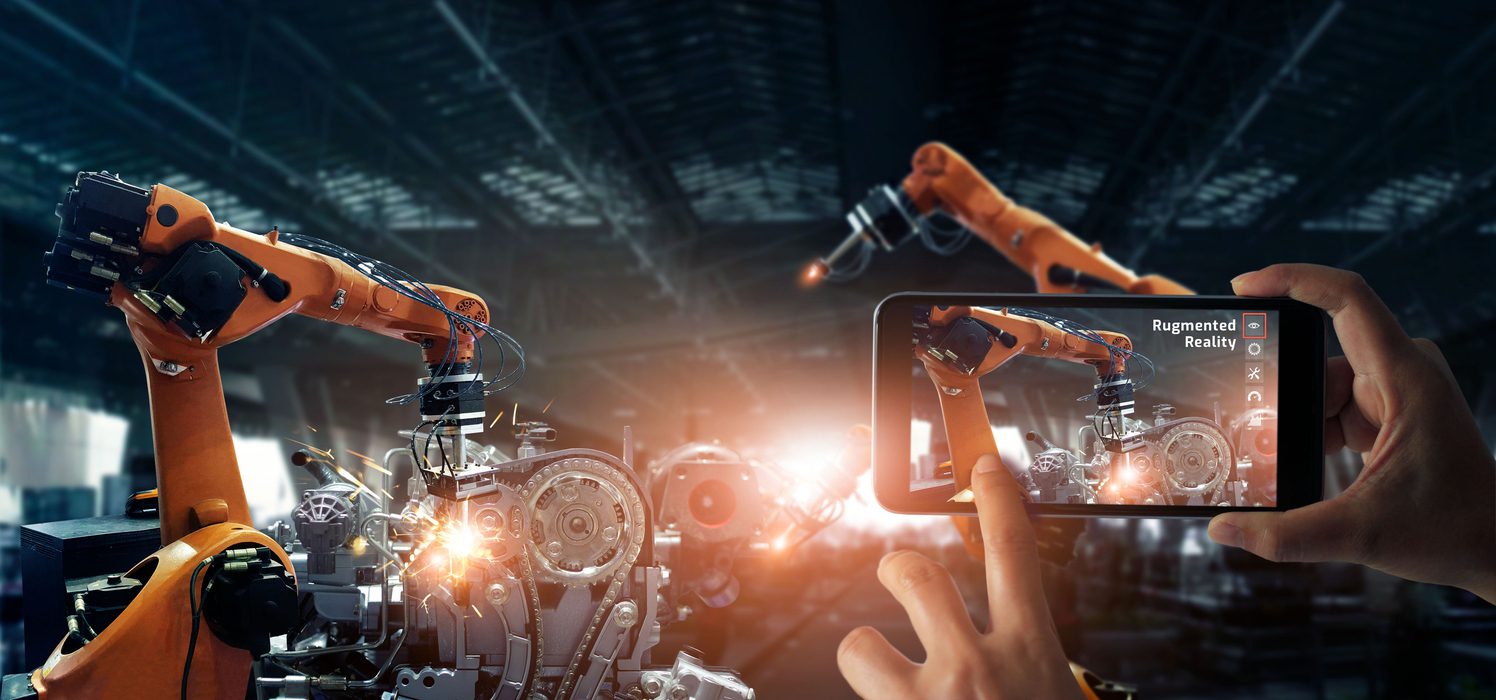

Stanley Black & Decker has also gone the accelerator route and launched their Manufactory 4.0 centre of excellence. The company saw that speed of innovation was making adoption and training difficult. To solve this, the centre now brings in new, leading-edge technologies to the organization while upskilling the workforce that will use it.

Cargill Digital Labs was founded in late 2016 to really push that more agile lean startup behavior internally. Cargill Digital Labs teams in Minnesota, Brazil, India, Bulgaria and beyond have produced everything from robots that herd cattle to cashless mobile payment systems for cocoa farmers in West Africa. The company didn’t stop there, but also developed partnerships with Hyperledger, Descartes Labs, Cainthus, Techstars, and others to push innovation internally and for its customers.

The problem?

We don’t hear enough about it! Maybe it’s from years of over-indexing on product marketing, a humble focus on solutions or too many companies by engineers and for engineers forgetting that engineers are people too.

Just as these companies are catching up in supporting accelerators, they’re also facing new entrants, expectations and innovations that make their forecasts uncertain. It’s time to enter the competition for public attention, investor buy-in and workforce engagement. The industrial companies leading the way in innovation have a leg up here, but it’s time to get loud about it.